OCP S.A. SUCCESSFULLY RAISED USD 300 MILLION THROUGH A TAP ISSUE ON ITS MAY 2024 INTERNATIONAL BOND

Download PDF - 138.95KBOCP S.A. successfully completed an additional USD 300 million bond issuance

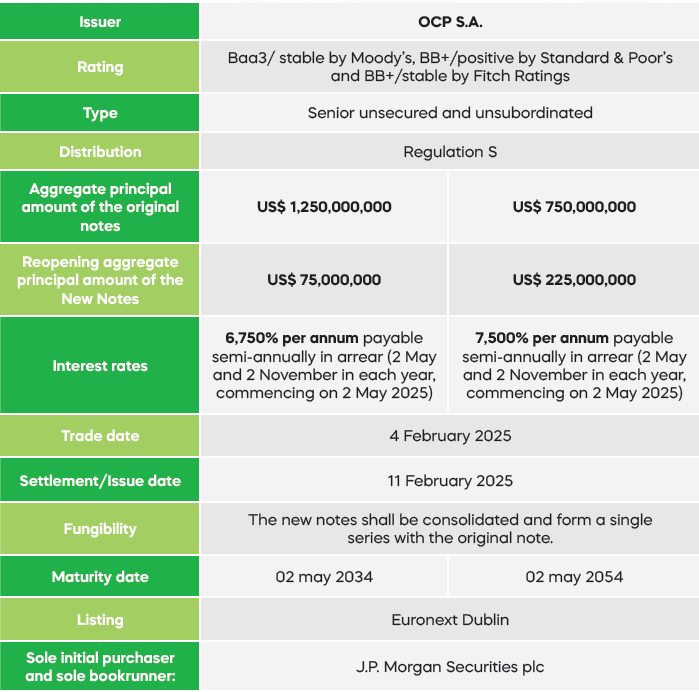

In accordance with the authorization of its Board of Directors on December 3, 2024, and pursuant to European Regulation (EU) 2017/1129 , which allows for the issuance of additional bonds within 12 months of the initial issuance under simplified conditions, up to a maximum of 30% of the original amount, OCP S.A. announced the successful completion of a USD 300 million Tap Issue. This additional issuance is linked to OCP’s May 2024 international bond issuance, which totaled USD 2 billion.

The new bonds have the same characteristics as the original issuance and will be fully fungible with the bonds issued in May 2024. They are structured into two tranches:

- USD 75 million maturing in 2034, with a 6.75% coupon

- USD 225 million maturing in 2054, with a 7.50% coupon

OCP plans to allocate the raised funds to financing its investment program and general corporate purposes.

The bonds are listed on EURONEXT Dublin and have received the following ratings:

- Fitch Ratings: BB+ (stable)

- Standard & Poor’s: BB+ (positive)

- Moody’s: Baa3 (stable)

The characteristics of the new bonds are as follows:

Contact

• Mrs. Ghita LARAKI

Head of Investor Relations

E-mail : G.laraki@ocpgroup.ma